This is the final article of a three-part series focused on JD Edwards Financial Integrity reports. In this article, I will review the subsidiary JD Edwards integrity reports for Fixed Assets, Inventory, and Payroll. These reports are useful in comparing each JD Edwards financial subsystem to the General Ledge.

To learn more about JD Edwards General Ledger and Batch Header integrity reports please view the first article in this series, .

To learn more about JD Edwards Accounts Payable and Accounts Receivable integrity reports please view the second article in this series, JD Edwards Financial Integrity Reports for Accounts Payable and Accounts Receivable. How Do They Add Up?

Fixed Asset Integrity Reports

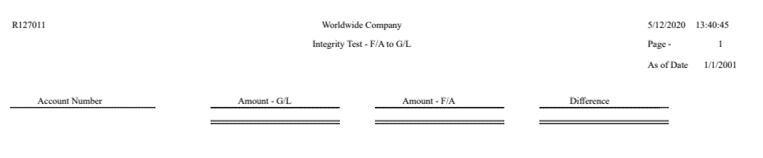

Fixed Assets to G/L Integrity (G1224, R127011)

Compares balance records in the Fixed Assets Item Balances File F1202 to the General Ledger Account Balances File F0902.

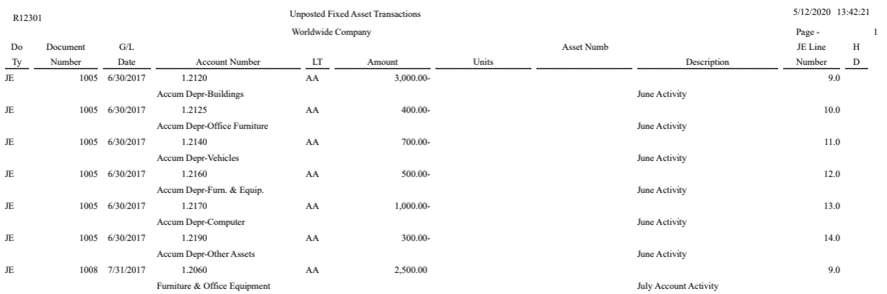

Unposted to F/A Transactions (G1224, R12301)

This report displays a list of all transactions that have been posted to the General Accounting System but have not yet been posted to Fixed Assets.

Fixed Asset Transaction Integrity/Report (G1224, R127012)

Reports a detail list of all transaction records from the F0911 Account Ledger for an Like a detail G/L report, this report is normally used to investigate outages.

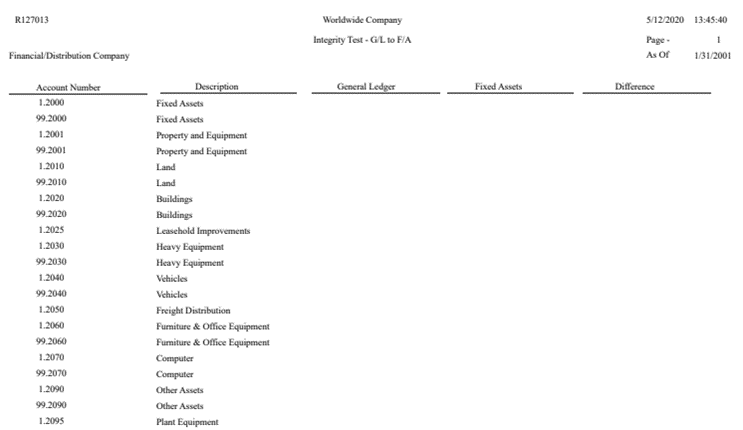

G/L to Fixed Assets Integrity (G1224, R127013)

Compares the General Ledger Account Balances File to balance records in the Fixed Assets Item Balances File.

Inventory Integrity Reports

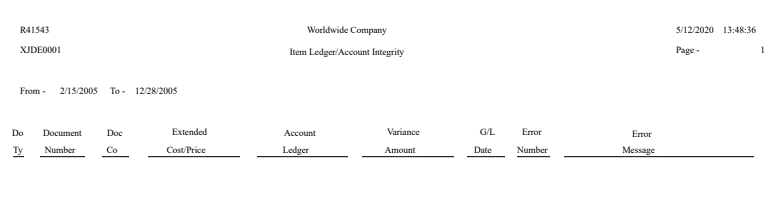

Item Ledger/Account Integrity Report (G41111, R41543)

Shows discrepancies that exist between the Item Ledger File F4111 and the Account Ledger F0911.

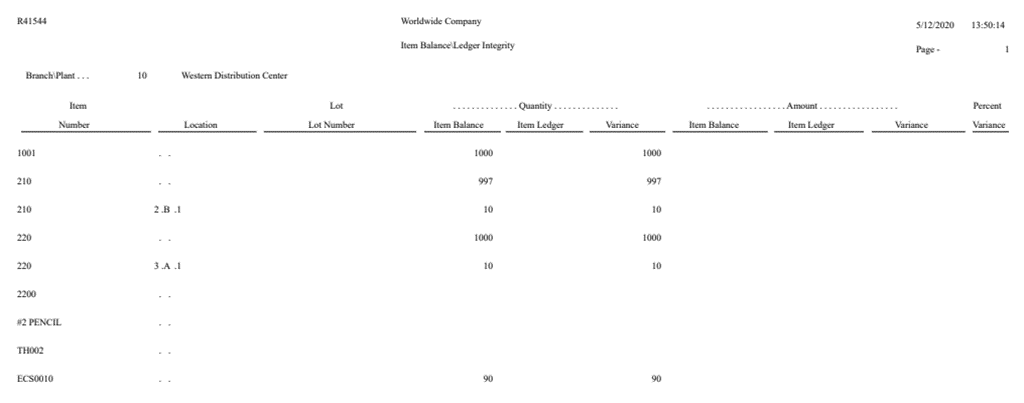

Item Balance/Ledger Integrity Report (G41111, R41544)

Compares the Item Ledger File F4111 to the Item Balance File F41021. Shows variance in amounts, quantities, or both.

Payroll Integrity Reports

Tax History Integrity Report (G07BUSP3, R077011)

Identify errors in your Tax History table (F06136).

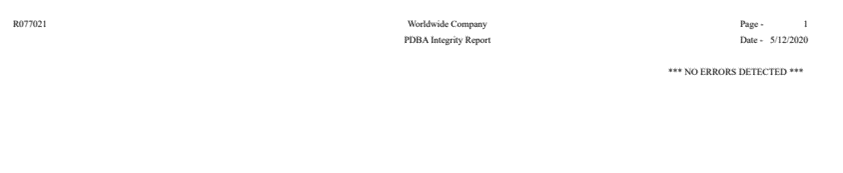

PDBA Integrity Report (G07BUSP3, R077021)

Identify errors in the Employee Transaction History Summary table (F06146).

Run these two reports during the Final Update process of every payroll.

Typical Causes of JD Edwards Integrity Issues

There are many reasons why integrity issues can arise within JD Edwards. See below for the most common.

- Power outages or interruptions – causing a temporary stoppage of the process.

- User interventions / job cancellations / errors – a user starts the process and then cancels it, causing errors.

- System failures – time outs, program failures, etccausing errors.

- Out-of-Balance batches – a batch was posted out-of-balance in error. (The batch override setting was changed to allow the batch to post out-of-balance).

- Partial postings – a batch of journal entries is partially posted due to a computer failure or power failure.

- Incorrect company numbers – the company was changed on a business unit record but the relevant tables were not updated.

- Missing Batch headers – transaction entries do not have batch headers and the batch cannot be posted.

- Invalid accounts – an unposted batch contains an invalid account and the batch cannot be posted.

- Incorrect editing codes – a manual journal entry was entered to an intercompany account. (Intercompany accounts should be assigned a posting edit code “M” to allow machine generated entries only ()).

- Single-threaded job queues – ensure that you post transactions using a single-threaded job queue. (It can cause issues if multiple applications access a record simultaneously).

Recommended Integrity Report Run Schedule from JD Edwards

Below is the integrity report order and cadence per the current JD Edwards recommendations.

- Fixed Assets to G/L Integrity (R127011) – Twice Monthly, 15th and 7th Business Day

- Unposted to F/A Transactions (R12301, ZJDE0001) – Twice Monthly, 15th and 7th Business Day

- Fixed Asset Transaction Report (R127012) – As needed to investigate out of balance

- G/L to Fixed Assets Integrity (R127013) – As needed to investigate out of balance

- Item Ledger/Account Integrity (R41543) – Twice Monthly, 15th and First of Month

- Item Balance/Ledger Integrity (R41544) – Twice Monthly, 15th and First of Month

- Tax History Integrity Report (R077021) – During the final update process of every payroll

- PDBA Integrity Report (R077021) – During the final update process of every payroll

Conclusion

There are two things that need to happen during the month to ensure your files in the general ledger and subledger systems are in balance. The first is to make sure all general ledger transaction files are posted, both in the GL and the subsystem. The second is to make sure that the companies within the trial balance file are balanced. It is recommended to run JD Edwards integrity reports or interactive applications throughout the month to catch any errors before month end, giving you more time to analyze errors and to determine the required corrections.

If you have the financials set up correctly, the general ledger file and trial balance should stay in sync and in balance, allowing you to complete efficient, error-free month end closes.