The National Automated Clearing House Association (NACHA) has specified a rule which states that companies with more than 6 million NACHA payments in 2019 or more than 2 million NACHA payments in 2020 must protect bank account numbers as of June 30, 2021 and June 30, 2022, respectively. To comply with this requirement and protect the data, accounting and payroll managers have the ability to mask bank account numbers in JD Edwards. The bank account numbers are masked when displayed in applications, reports, and data browsers as well as in transaction files, master files, and work files.

But once all bank account numbers are masked, how can you unmask them when there is a business need? For Example, if a bank account changes, somebody needs to be able to update that account in JDE. JDE provides an option to define exceptions from masking on an as needed basis. E1 reports will always mask bank account numbers, no exceptions allowed.

To achieve this, you will need to set up a configuration rule in Work with Data Protection Configuration (P0040). The rule can be specified for a USERID/ROLE or a Program. These exceptions can grant permission to view or update the bank account number.

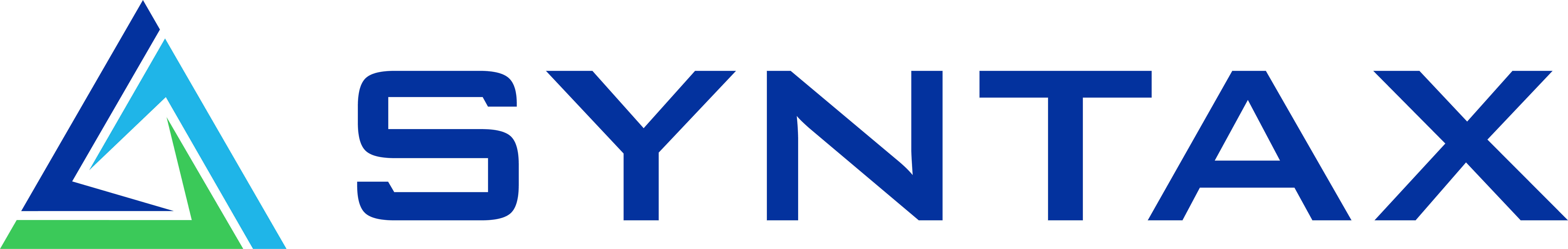

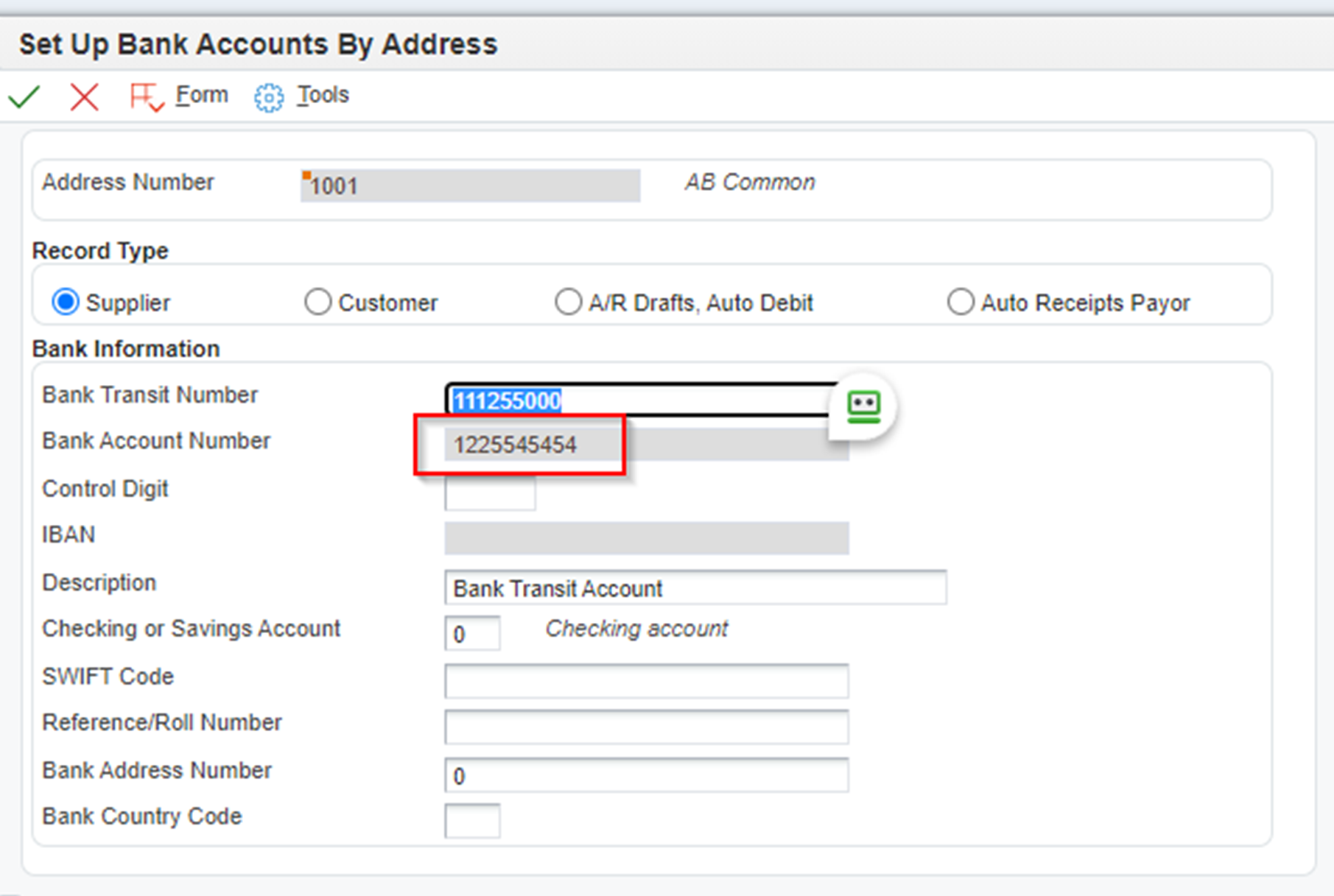

In the below example, bank account numbers are masked prior to creating an exception:

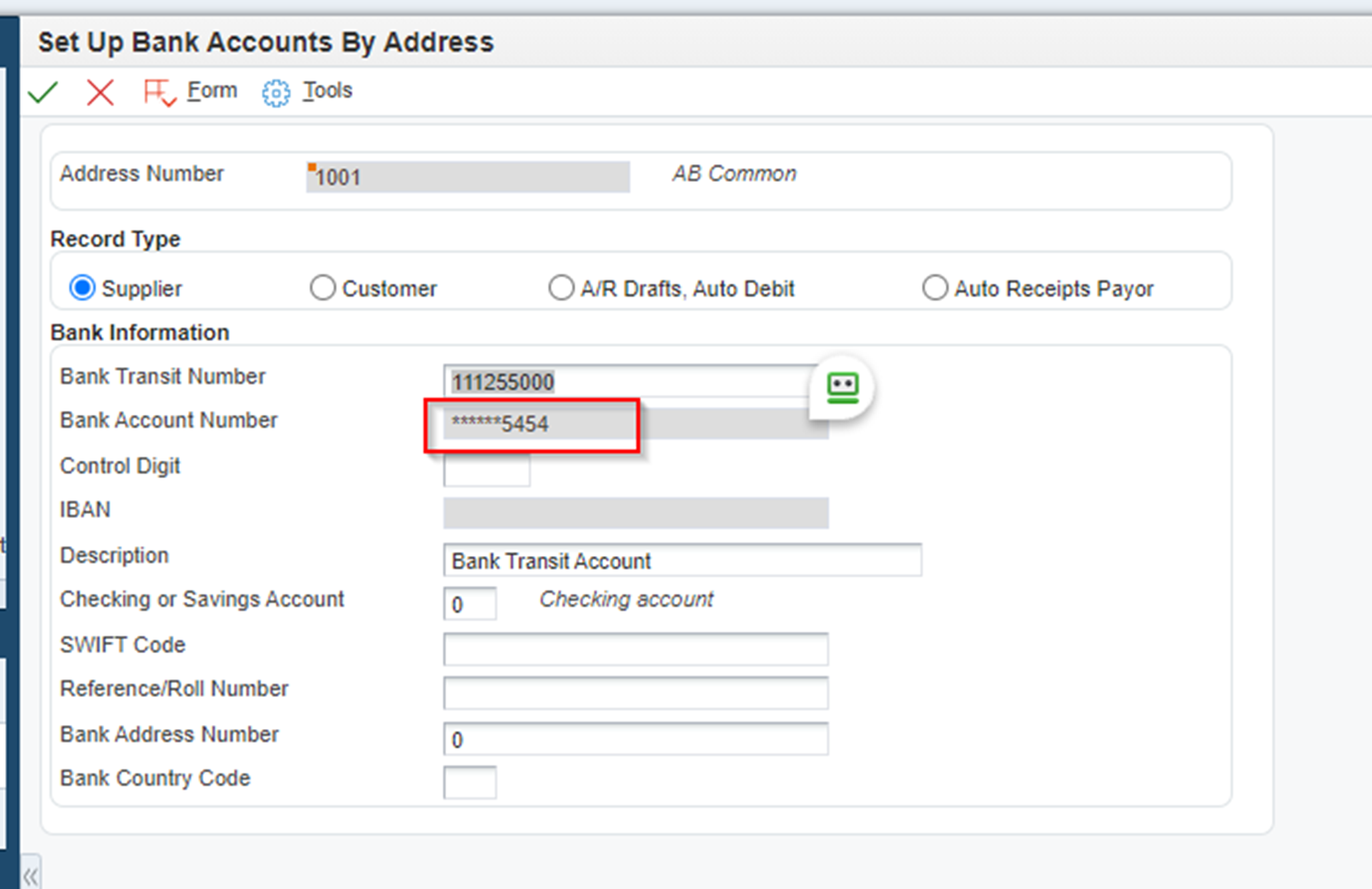

Let’s create a new exception using Work with Data Protection Configuration (P0040):

- Configuration Record Type 1 will give ALL Users access to view/modify unmasked bank account numbers in the listed program.

- Configuration Record Type 2 will only give access to a specific User ID or Role.

Note: The system will give precedence to a USER ID over a ROLE. If you give a permission for a ROLE to update the bank account but a USER in that ROLE only has permission to view, then they will not be able to modify the bank account.

Now the specified USER ID can view the Bank Account numbers:

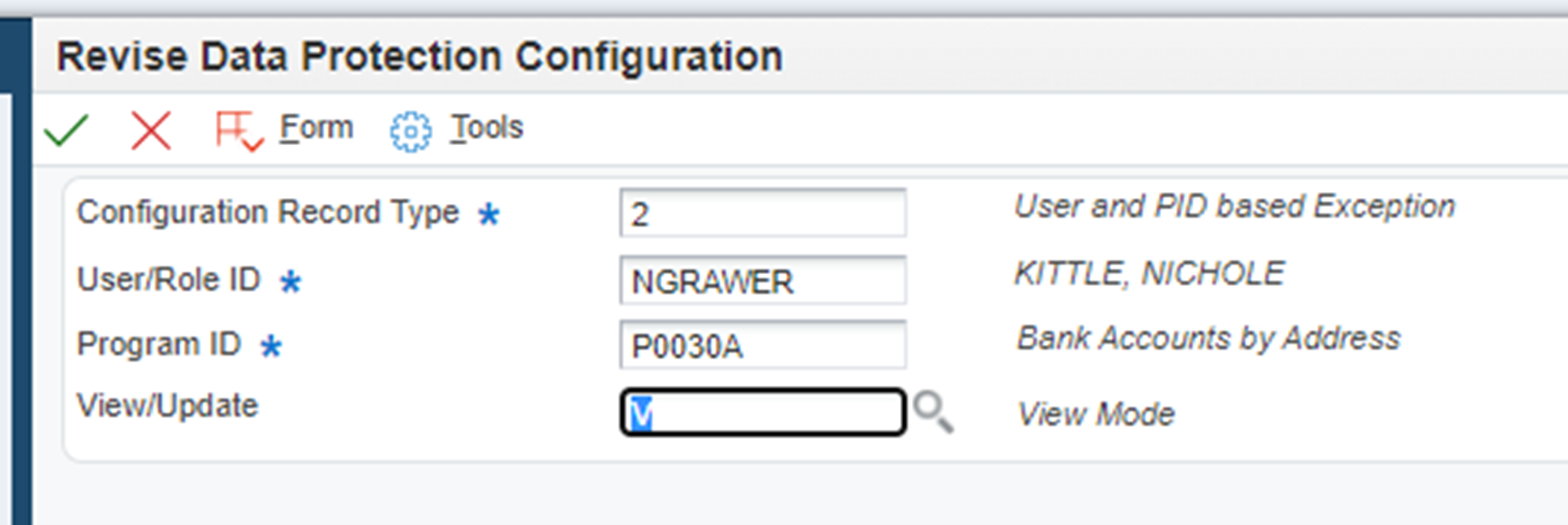

The complete list of programs that allow exceptions to be setup are included in UDC 00/PI. These programs are masked by default.

- P0030A: Bank Accounts by Address

- P0030G: G/L Bank Accounts

- P004201: Prepayment Transaction Process

- P03B121: Work With Electronic Receipts

- P03B123: Electronic Receipt Entry

- P03B602: Draft Entry

- P03B675: Draft Registers for Payment

- P0413M: A/P Manual Payments

- P0474N1: A/P Enterprise Info. – Sweden

- P05137: Work With HR/ADP Data

- P055011: Auto Deposit Instructions

- P07236: Auto Deposit Instructions for Business Units

- P07351: Payment Distribution Review

- P09160: Bank Statement Review/Entry

- P09610: Revise Electronic Bank Statement

- P09610T: Revise Electronic Bank Statement Test

- P09616: Revise Auto Bank Statement

- P09616T: Auto Bank Statement Test

- P09621: Bank Accounts Cross Reference

- P4004Z: Recurring Orders

- P4210: Sales Order Entry

- P42101 Sales Order Entry

- P47046 Outbound EDI Invoice Inquiry

- P47110 EDI Lockbox Status Inquiry

- P740001: SEPA Account Setup – COMM – 74

- P74030H: Dutch Payments Bank

- P75A0006: Copy Payroll Payments To Bank

- P75C030: Additional Bank Information – CHINA – 75C

- P76B474O: Bank Transaction Outbound Proc for Dynamic Format – 03B

- P76C0003: VAT Withholding Certificate

- P76C0F53: DIAN Concept Review For Receip COL – 03B

- P76C575A: Information Update – Col – 04

Note: It is Important to secure the P0040 so that only specific owners can access the program and configure exceptions.

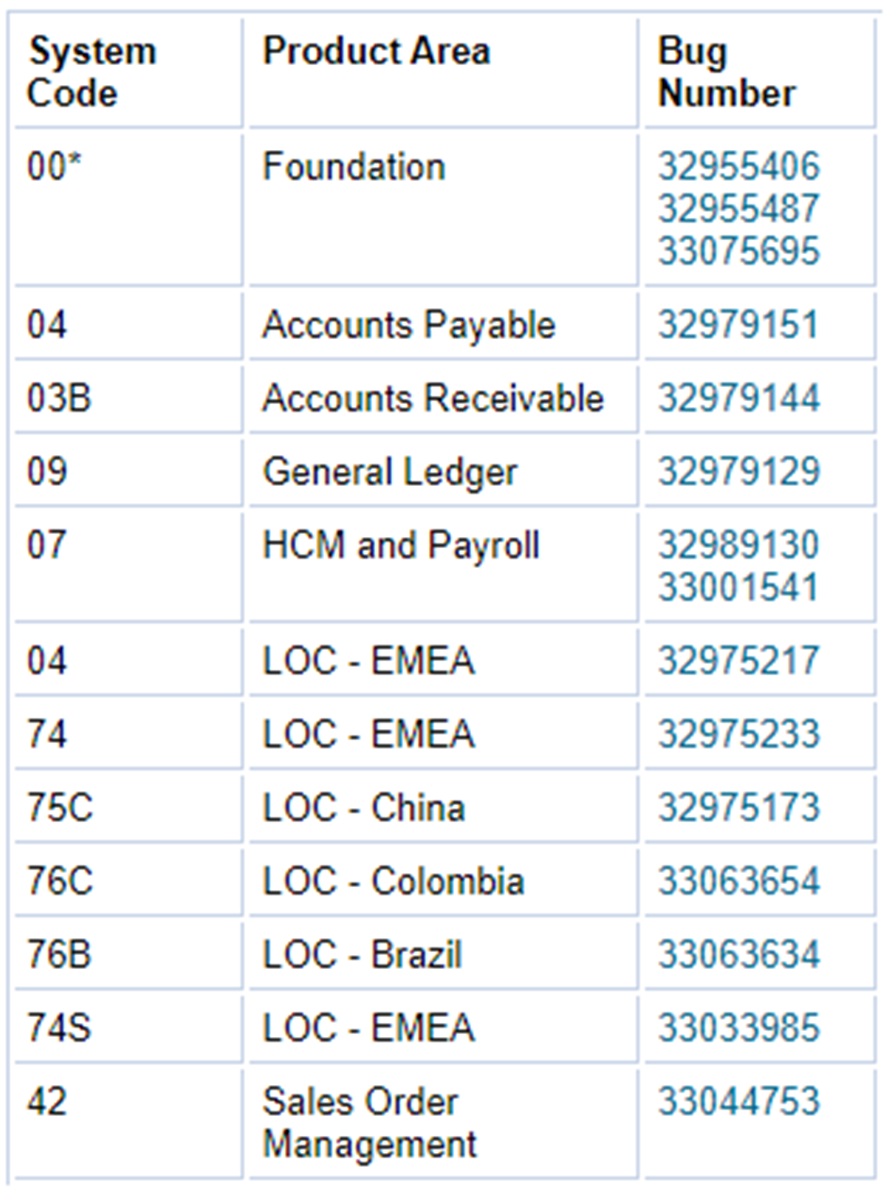

Also be aware, each system code has its own bank account numbers, related Data Dictionary items, and impacted objects. The changes for each system code will need to be downloaded using the following BUG numbers.

Conclusion

Work with Data Protection Configuration (P0040) enables JD Edwards customers to allow specific USER IDs or ROLES to view unmasked bank account numbers to change or update those details based on business circumstances. This solution permits access while continuing to protect the data and limiting accessibility.